Wealthy Americans aren’t spending — or earning — like they used to.

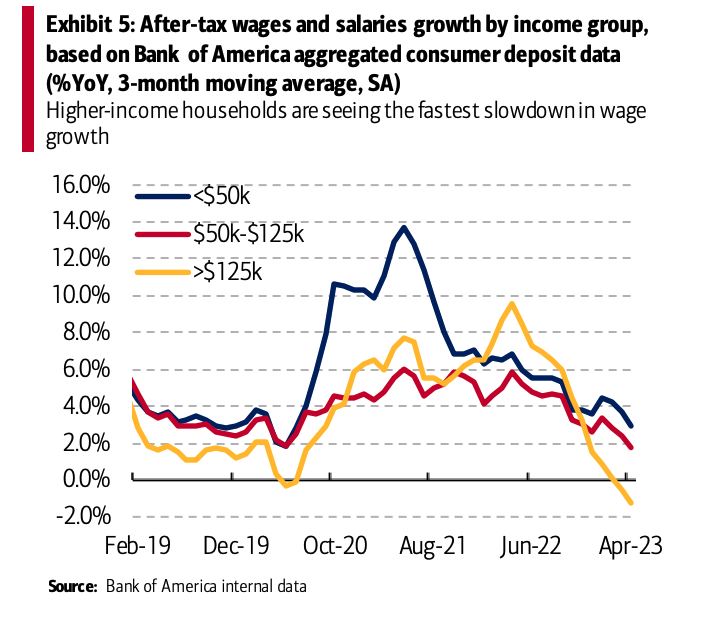

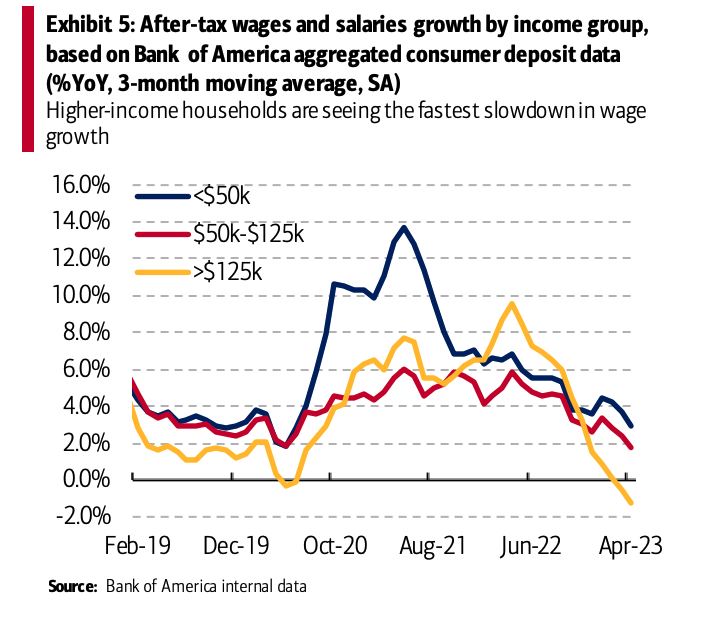

Wednesday’s data from the Bank of America Institute found that households earning more than $125,000 saw wage growth slow faster than lower-income households, while spending trends followed a similar pattern. Discretionary spending by high-income households on Bank of America credit and debit cards has been lower than that of low- and middle-income groups since earlier this year.

The data is significant, Bank of America argues, because the top 40% of households by income account for more than 60% of overall consumer spending. Its salary calculation includes bonuses, which fluctuate more than the base salary.

“A labor market downturn driven by the higher end of the income scale could have a larger impact on the overall economy,” BofA wrote in a note to clients. “As of right now, the labor market is starting to soften from a very buoyant initial position, so it will take some time before the full impact on consumer spending comes through.”

Unemployment remains at historically low levels, according to Bank of America Claims for unemployment benefits Rising fastest among the highest income groups. Higher-income households filing for unemployment benefits rose 40% in April from the same month a year earlier — more than five times the rate for the lowest income bracket, according to BofA internal data on direct deposits to consumer accounts in 30 states.

So the April jobs report showed that the overall recovering labor market is coming in hotter than expected 13th straight monthBofA’s data also shows that cracks are occurring in the high-income bracket, where headlines of layoffs have gripped the tech industry for months.

Overall, Total card spending fell on an annual basis in April for the first time since February 2021, according to Bank of America data. In retail, luxury fashion is the biggest laggard, down 15% compared to 2022. Among services, accommodation fell more than 3% compared to last year while spending on airlines fell 4.5% compared to the previous month.

Savings and checking balances at Bank of America are still more than 40% above pre-pandemic levels, in line with slower trends in spending. Other financial data from each month and commentary from quarterly earnings calls.

Retail sales fell to twice what analysts had predicted in March, as some economists suggested the picture was growing worse.

“Monthly data suggest that consumer spending has lost momentum over the past few months,” Wells Fargo Chief Economist Jay Bryson said in a note on April 27. “Furthermore, consumers are increasingly relying on credit and cash on hand to finance their purchases. These factors are unsustainable in our view.

“We forecast that the US economy will slide into recession, which we expect will be of moderate intensity in the second half of the year.”

‘Consumer beware’

Some of America’s biggest consumer brands showed similar warning signs during their earnings calls. Amazon ( AMZN ) warns of “cautious spending.” 3M Company ( MMM ) sees weakness in “consumer-facing markets.” And Procter & Gamble (PG) said its “more cautious” customers are conserving sheets of paper towels.

The gloomy outlook comes as several big-box retailers have yet to report earnings. Home Depot ( HD ), Walmart ( WMT ) and Target ( TGT ) are all expected to report first-quarter earnings next week.

And while earnings broadly beat the Street’s muted first-quarter expectations, investors will be closely watching what each company says about the remaining nine months of 2023.

“Earnings season in retailers, in my opinion, is going to provide a lot of opportunity for individual investors in terms of where to look next, and a key part is going to be those CEO comments,” JJ Kinahan, CEO of IG North America, told Yahoo Finance Live on Monday.

Josh is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

#Wealthy #Americans #hit #hardest #economy #slows